Awesome Info About How To Buy An Rrsp

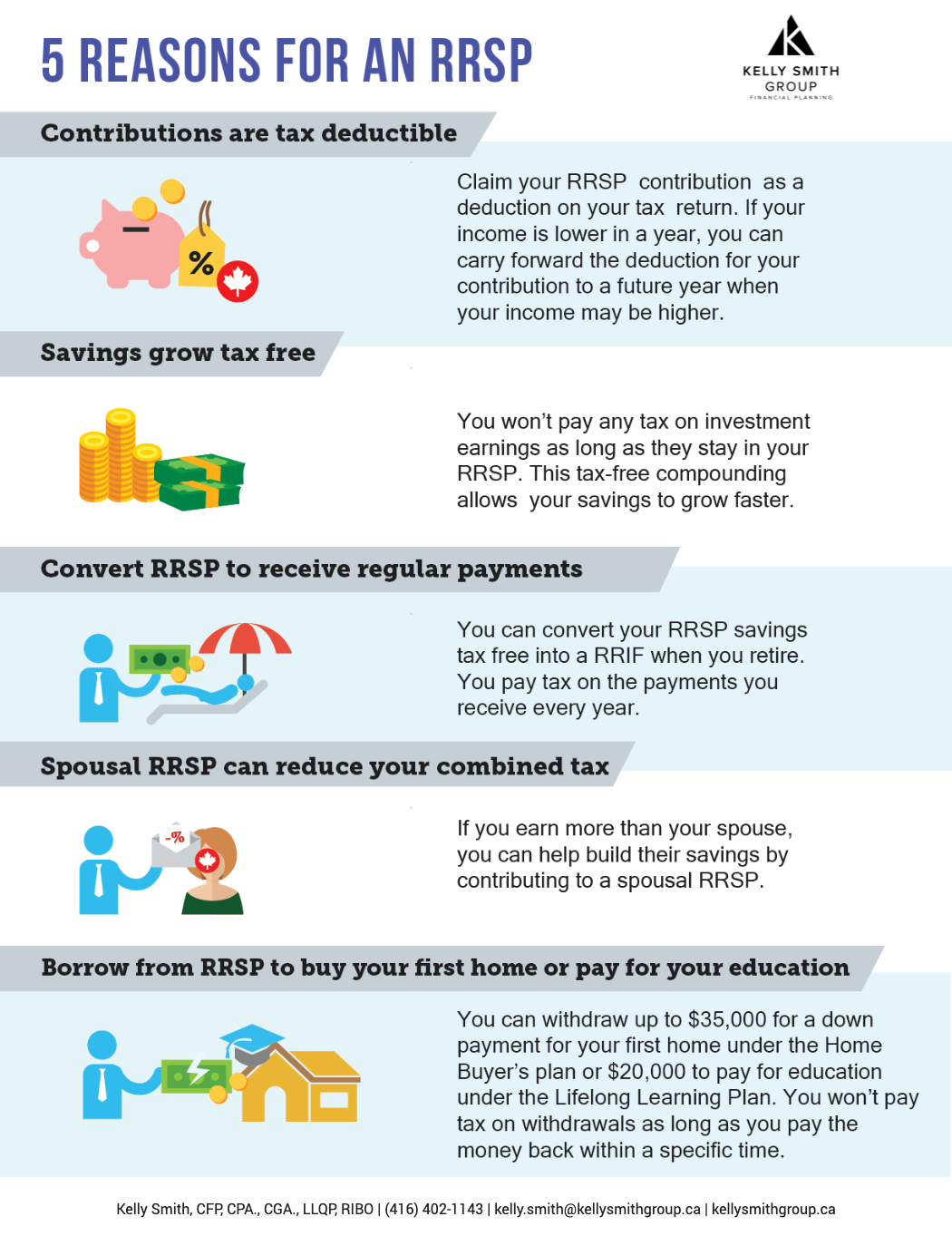

18% of your earned income from the previous tax year, or.

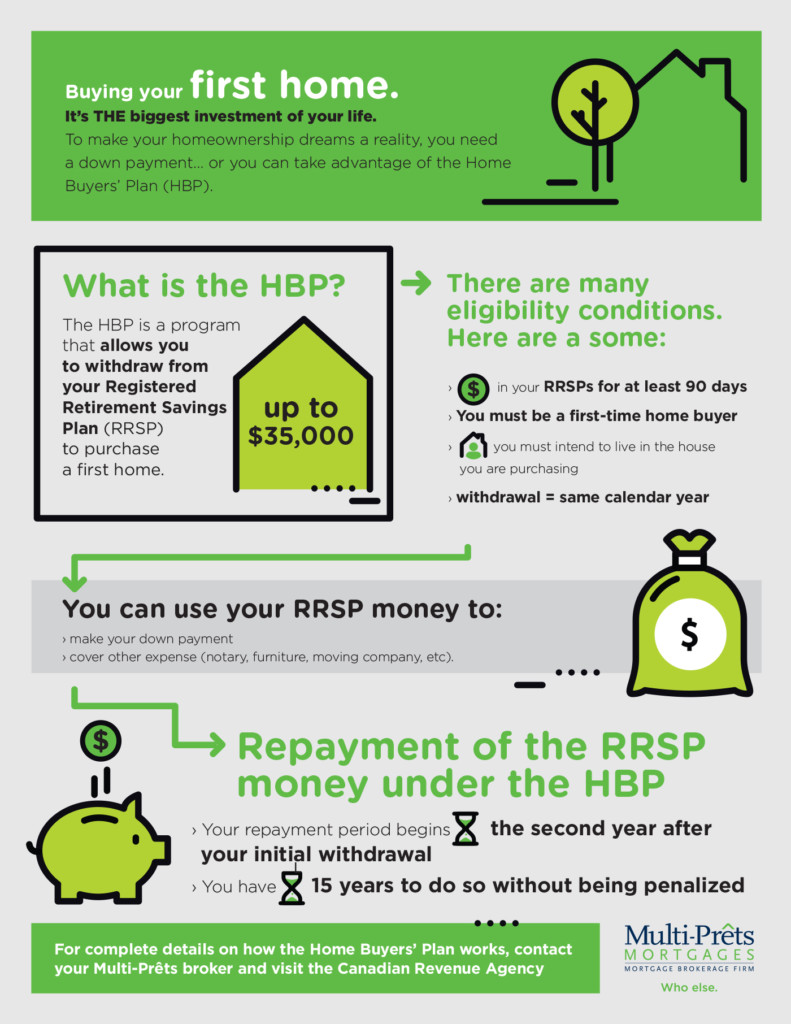

How to buy an rrsp. Rrsp contributions can help change your tax outcome. Simply fill out a rc471 form and provide details to the government as to why you have decided to note participate in the home buyers plan. Shop around to compare fees and plans.

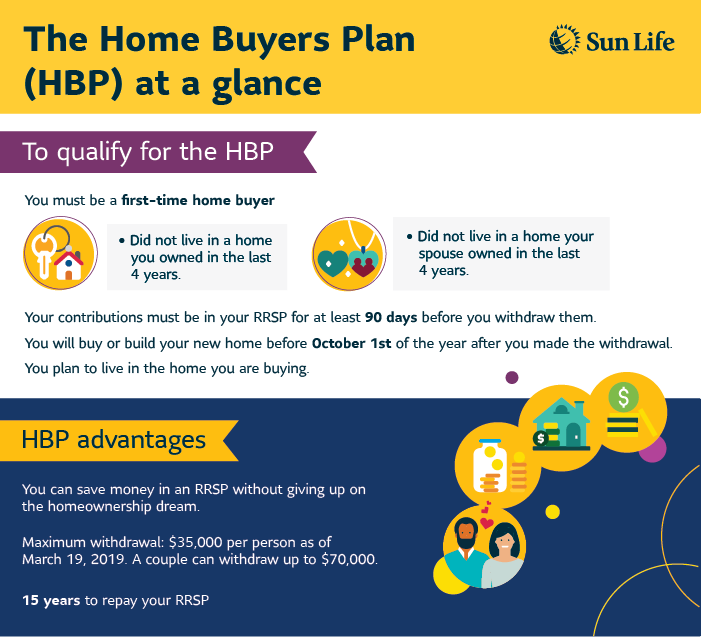

Pros of the home buyers’ plan. The amounts contributed to your rrsp reduces your net income. You are a resident of canada.

A complete guide to buying a home in canada. You’re allowed to designate one or more individuals as a beneficiary. Use the money in the rrsp to purchase what’s known as an annuity;

You must also have a signed agreement to buy or build a home and you must be living in it within a year. For some people, the funds you can withdraw from. If your rrsp is with a brokerage or mutual fund company that will need to wire or mail you a cheque, open an rrsp savings account with the nearest bank or credit.

As a cyclical firm, nfi is bound to face ongoing sales pressure once the recession arrives. Your financial institution will advise you on the types. Deductible rrsp contributions can be used to.

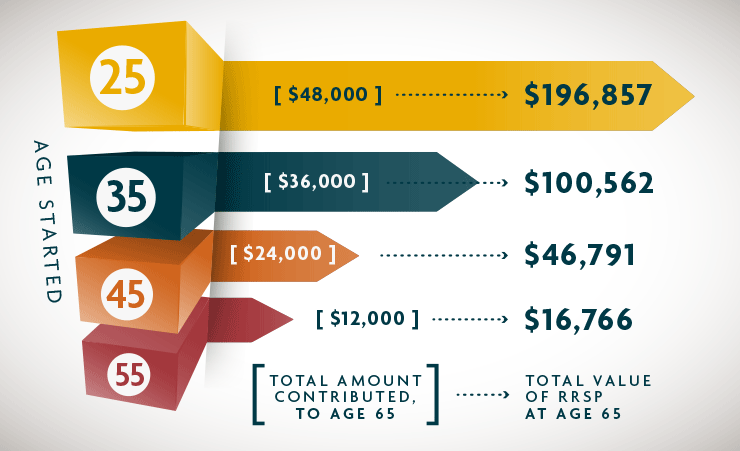

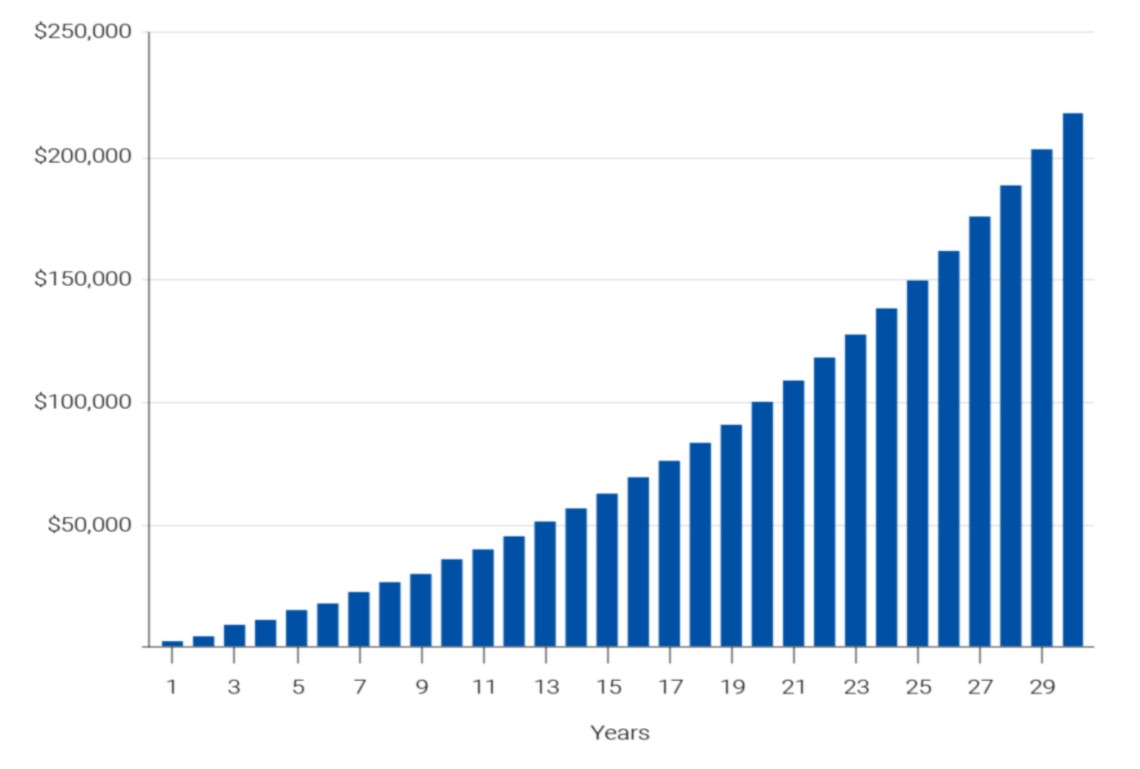

To calculate your rrsp lifetime limit, add up each years' rrsp limit starting from the year you turned 18. The agreement may be with a builder, contractor,. Convert the rrsp into a rrif;