Neat Info About How To Keep A Good Credit Rating

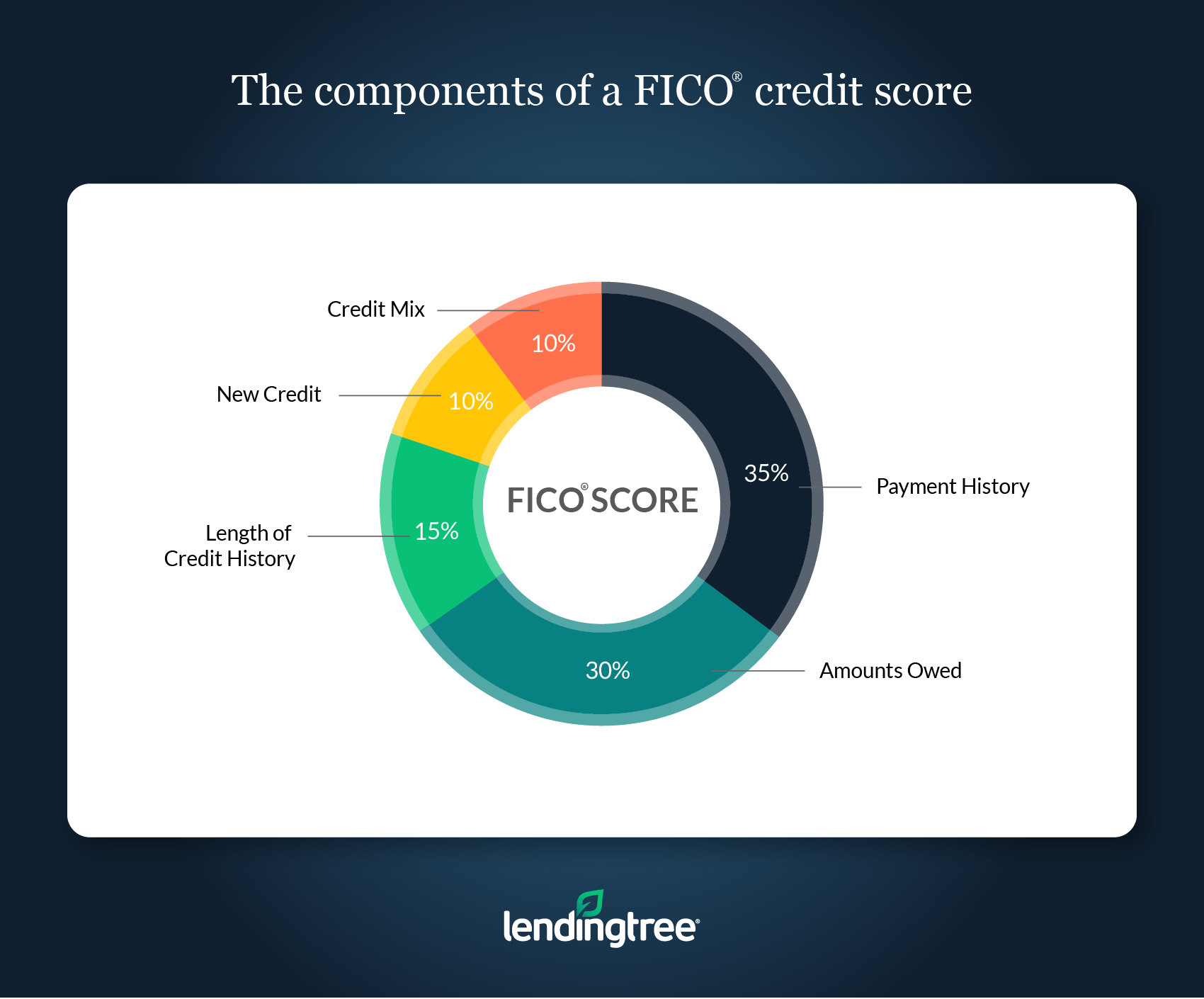

As we mentioned above, paying your bills on time is the biggest piece of the credit score pie.

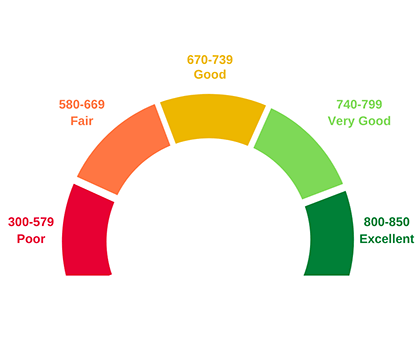

How to keep a good credit rating. If your credit card limit is $1,000, you can spend $300. Maintain a good credit score by understanding the scoring factors, automating your bills, keeping debt in check and regularly monitoring your credit. If you spend more than 30% of your limit, that hurts your credit.

14 helpful tips for maintaining a good credit score 1. Most people preach that to maintain a good credit score, you must have a few credit cards. Pay your bills on time.

The second most important thing you can do to maintain a good credit score is to stay below your “credit utilization limit.” what does this mean? Your credit score takes into account both revolving debt,. Avoid making late credit card payments and continue to keep your balance at a reasonable level (below 30% of the credit limit) to maintain a good credit score.

Credit utilization is the next largest factor, making up 30% of your overall credit score. In fact, it is the most influential factor for fico and vantagescore. Ad learn 7 actionable tips to help rebuild your credit and improve your score.

Pay down your credit card balances to keep your overall credit use low. Some experts recommend keeping your credit utilization rate below 30%, but two credit gurus cnbc select spoke to say it should be much lower than that if you want a good. Get your credit score & equifax credit report.

Pay your bills on time. A credit score is primarily based on a credit. Learn more about ways to help you rebuild your credit score.

/credit-score-factors-4230170-v22-897d0814646e4fc188473be527ea7b8a.png)